Risk management is a critical aspect of every business, regardless of its size or industry. Effectively identifying and managing risks helps companies adapt, grow, and succeed in an increasingly competitive landscape. In 2023, the risk management software market was valued at $13.8 billion and is projected to grow at a 7.4% CAGR through 2030. As organizations seek more efficient ways to assess and mitigate risks, many are turning to risk management software to enhance their processes and gain a clearer understanding of potential threats.

But how do you choose the right risk management software? With so many options on the market, it can be overwhelming to know where to start. Below, we’ll dive into the key features you should look for to ensure that the software you choose will help you effectively manage and mitigate risks.

1. User-Friendly Interface

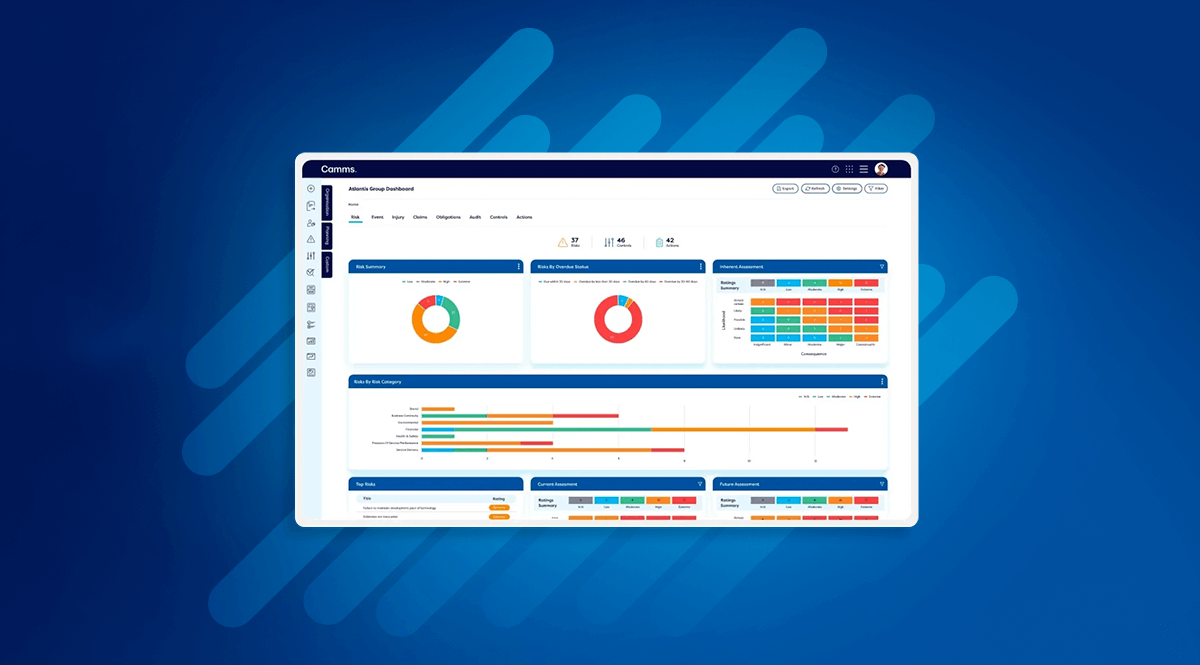

One of the most important features of any software, especially for risk management, is a user-friendly interface. If the software is complicated to navigate, it will not serve its purpose effectively. A clean, intuitive interface helps users understand the system quickly so they can focus on managing risk rather than struggling with it.

When evaluating options, make sure the software has a dashboard that provides an overview of the current risks, their statuses, and any necessary actions. It should be simple for both technical and non-technical team members to use, allowing for easier adoption across departments.

2. Risk Identification Tools

The first step in managing risk is identifying it. Risk management software should make it easy to pinpoint potential hazards in your business. This could include risks related to finance, operations, compliance, technology, and more.

Look for software that allows you to create custom risk categories and track risks across different business areas. The ability to visualize risk areas and identify emerging threats in real time will provide you with a clear picture of where attention is needed.

3. Risk Assessment and Scoring

Once risks are identified, the next step is to assess their potential impact and likelihood. Effective risk management software should provide tools for evaluating the severity of each risk and its probability of occurrence.

The software should allow you to score each risk, either manually or automatically, to prioritize them based on factors like potential harm and the likelihood of occurrence. This will help you focus your resources on the most critical risks, preventing unnecessary distractions from less significant issues.

4. Risk Mitigation and Action Plans

Risk management proceeds to its next phase after performing risk identification and assessment. The risk management software should let users develop action plans to specify how dangers will be managed or minimized.

Check the software offers functionalities to assign work orders to team members while setting timestamps and tracking how well your team executes mitigation plans. The system enables all team members to share the same understanding so actions are executed promptly. The program must include notification features that help users fulfill all necessary tasks.

5. Reporting and Analytics

Access to clear, detailed reports is vital to understanding the current state of risk management within your organization. Risk management software should provide robust reporting tools that give you insight into your risk landscape.

Look for software that allows you to generate customizable reports, whether it’s to evaluate the effectiveness of your risk mitigation strategies, review historical data, or present findings to stakeholders. Reports should be easily shareable so that all relevant parties can stay informed about risk status.

Analytics tools are also important, as they allow you to analyze patterns over time. The software should track trends, helping you understand if your mitigation strategies are working or if adjustments are needed.

6. Integration Capabilities

In today’s fast-paced business environment, risk management software must integrate with the other tools and platforms your business already uses. Whether it’s financial software, project management tools, or compliance systems, this ability to integrate can save time and increase efficiency.

When reviewing risk management software, check if it supports integration with the tools your team already uses. This feature eliminates the need for duplicate data entry and streamlines the overall workflow.

7. Collaboration Features

Risk management is rarely a solo task—it involves multiple teams and departments working together. Collaboration features in risk management software make it easier to share information, communicate risks, and track progress across teams.

Look for software that supports internal communication tools, such as chat or comment sections, within the system itself. This makes it simple to discuss risk issues and share updates without switching between different platforms. Real-time collaboration ensures that all relevant stakeholders stay in the loop and can take necessary actions promptly.

8. Customization Options

Each enterprise possesses distinctive qualities that lead to different threats they need to handle. Risk management software needs flexibility to adapt to the unique needs and operational procedures present in each business. Evaluate software for its customizable features since they enable user-specific adjustment according to risk profiles.

This could include adding custom fields, creating personalized reports, or adjusting the risk scoring system. The more flexible the software, the better it will fit your organization’s goals and processes.

9. Compliance Management

For many organizations, compliance with industry regulations and standards is a critical part of risk management. Risk management software should include features that help track and manage compliance requirements.

Search for software that contains features to safely manage regulatory documents while tracking scheduling requirements and establishing compliance monitoring capabilities. Your software system must have an alert system that will notify you about both upcoming deadline dates and modifications to the relevant laws so you can maintain business compliance at all times.

10. Security Features

Given the sensitive nature of risk management data and the 10% increase in data breaches from 2023, security should always be a priority. Choose software that offers strong data protection through encryption, secure logins, and access controls to safeguard critical information.

Ensure that the software includes features like multi-factor authentication (MFA) and role-based access controls so that only authorized users can access sensitive information. This helps to prevent unauthorized access to critical data and reduces the risk of security breaches.

11. Scalability

As your business grows, so will the complexity and scale of the risks you face. Therefore, it’s important to choose risk management software that can grow with your organization and adapt to your changing needs over time.

When evaluating software, consider whether it offers scalable features that can grow with your business. This could include the ability to add more users, increase storage capacity, or support more complex risk scenarios as your operations expand.

12. Mobile Access

In today’s mobile-first world, having access to your risk management system from anywhere is a key advantage. Mobile access allows your team to monitor risks, collaborate on mitigation efforts, and make important decisions, even when they’re away from their desks.

Look for software that offers a mobile app or responsive web design, so your team can access risk data on the go. This flexibility is especially useful for teams that are constantly in the field or working from different locations.

13. Vendor Support and Training

Finally, it’s essential to consider the support and training that the software provider offers. Risk management software is a significant investment, and you’ll need ongoing support to ensure it’s working properly and that your team is fully trained to use it.

Select a software provider that provides complete customer assistance with training resources and user manuals, together with a dedicated support group. A proper software provider should maintain availability to help solve any post-implementation problems that their customers encounter.

Conclusion

An ongoing risk management process needs suitable tools to succeed. Risk management software selection based on appropriate features allows organizations to conduct efficient, proactive risk recognition and assessment and reduction operations.

Your search for appropriate software to manage risks consists of observing two things: an intuitive interface and built-in risk identification capacities alongside assessment instruments, plus plan generation abilities and analytics reports and maintained security protocols. These important factors will enable you to choose suitable software that helps your business handle risk management challenges effectively.

Organizations interested in holistic risk management solutions can find one complete answer through risk management software, which provides capabilities for identifying risks and assessing them while building mitigation strategies and creating reports. Team organization and proactive readiness against changing challenges become possible through the use of this platform.